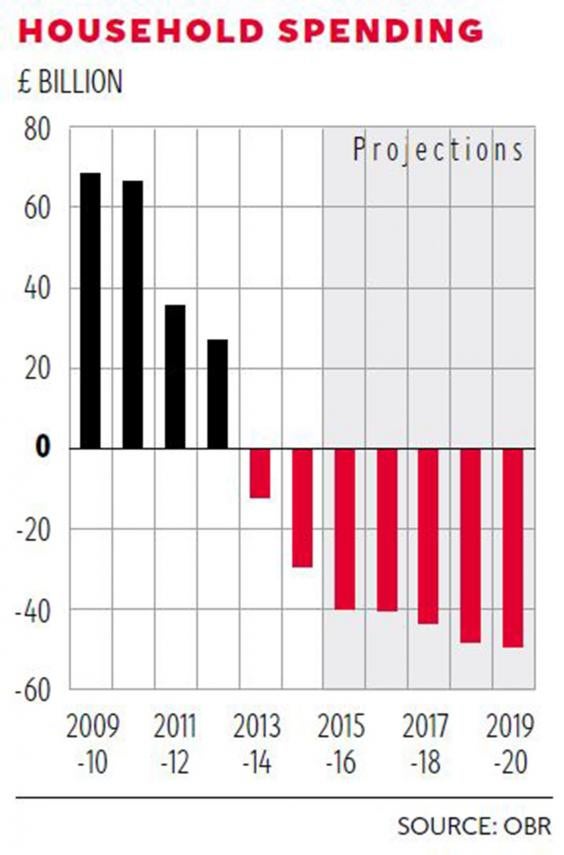

British families are on course to spend £40bn more than they earn this year, fuelling fears that the country’s economic growth is based on soaring levels of debt and could easily collapse.

The forecast by the independent Office for Budget Responsibility (OBR) led to warnings that the UK could be heading towards a credit crunch similar to that of 2008 because of unsustainable levels of borrowing and household spending.

Five years ago UK households were firmly in the black, running a surplus of £70bn as Britons tightened their belts in the wake of the financial crash and put money aside to save.

But the new OBR figures show households are now deeply in the red, as growing economic confidence has led to a national spending spree.

Seema Malhotra, the shadow Chief Secretary to the Treasury, said: “George Osborne is relying on millions of British families going further into debt to hit his growth targets. This is risky behaviour from a Chancellor whose policy decisions are hurting not helping British families. Alarm bells should be ringing. There is a real risk that millions of families will face serious hardship if interest rates start to rise.”

UK news in pictures

-

1/30

22 December 2015People gather to take a selfie photograph as pagans and revelers gather at Stonehenge, hoping to see the sun rise, as they take part in a winter solstice ceremony at the ancient neolithic monument of Stonehenge near Amesbury, Wiltshire. Despite a forecast for rain, a large crowd gathered at the famous historic stone circle, a UNESCO listed ancient monument, to celebrate the sunrise closest to the Winter Solstice, the shortest day of the year. The event is claimed to be more important in the pagan calendar than the summer solstice, because it marks the ‘re-birth’ of the Sun for the New Year.

-

2/30

21 December 2015An employee sorts deliveries at Royal Mail’s Mount Pleasant Mail Center in London. This week is expected to be the busiest of the year for Royal Mail as they deal with deliveries in the run up to Christmas.

-

3/30

20 December 2015London buses pass under Christmas lights on Oxford Street in central London, on the final shopping Sunday before Christmas.

AFP

-

4/30

19 December 2015A supporter wears a t-shirt featuring the face of Chelsea’s former Portuguese manager Jose Mourinho before the English Premier League football match between Chelsea and Sunderland at Stamford Bridge

AFP/Getty

-

5/30

18 December 2015Josh Clewley harvests Brussels sprouts at Essington Fruit Farm in Wolverhampton for the Christmas market

-

6/30

17 December 2015Armed police stand guard outside Number 10 Downing Street in London as security across the city has tightened in the run up to Christmas

-

7/30

16 December 2015Deborah McGibbney (left) and Nishma Rana, employees at Royal Mail’s Glasgow Mail Centre, wear Santa hats as they help to handle millions of items during the Christmas rush on the centre’s busiest day of the year

-

8/30

15 December 2015Farmer Harvey Maunder walks with his flock of free-range geese that he has reared for the Christmas table, in front of the farmhouse at Home Farm in the village of Kingsweston near Somerton. The birds, which have been reared as free-range from chicks and have already broken out to eat Mrs Maunder’s Christmas sprouts, are due to be dispatched and prepared for the farm shop’s customers

-

9/30

14 December 2015Ascot Racecourse has unveiled the ‘foursie’ – a festive onesie tailor-made for Shetland pony, Daffy. The foursie has been made to keep Daffy warm as the cold winter approaches. Ascot is encouraging race goers to don their festive finery ahead of its Christmas Racing Weekend which takes place on the 18 and 19 December, with racegoers encouraged to donate to a host of local good causes

-

10/30

13 December 2015Oxford’s ‘Business’ (left) and ‘Pleasure’ (right, white arms) pass the Harrod’s Depository during the BNY Mellon University Boat Race Trial 8’s on The River Thames in London

-

11/30

12 December 2015Demonstrators wave a Syrian flag during a Stop The War Coalition protest as protesters march along Whitehall in London

-

12/30

11 December 2015Royal British Legion standard bearers march ahead of the hearse at the funeral service for 90-year old World War Two veteran Thomas Cox in Middlesbrough. Following an appeal on social media hundreds of people attended the service for the World War Two veteran from Stockton who served with the Royal Pioneer Corps and who died recently without any family members being able to be found

-

13/30

10 December 2015John Lewis’s Christmas tree farm, Netherraw Forestry in Scotland, is set for a busy festive season as the retailer reveals a huge surge in demand for real Christmas trees

-

14/30

9 December 2015Model makers Hannah Reed (left) and Amanda Green put the finishing touches to a huge 6.7kg Lego Angel which is on top of a giant 8m tall Christmas tree made of Lego bricks at the Legoland Windsor Resort in Berkshire

-

15/30

9 December 2015St Paul’s Choristers prepare to sing during a rehearsal at St Paul’s Cathedral in London. It is estimated that on the 23rd, 24th and 25th of December alone, more than 10,000 people will come through the doors of St Paul’s for Christmas services

-

16/30

8 December 2015Christmas shoppers browse stalls at the traditional Christmas market close to the historic Roman Baths and Bath Abbey in Bath

-

17/30

8 December 2015The Boy Choristers of Winchester Cathedral Choir skate on the Cathedral’s ice rink which will be open until the 3rd of January

-

18/30

7 December 2015Shop workers clear rubbish from a store in Cockermouth, northern England, following heavy flooding in the town. Thousands of homes and business were affected by the heavy rains and strong winds that battered Britain over the weekend, with one death reported in London after a man was blown into the path of a bus, police said

-

19/30

6 December 2015A rescue team helps to evacuate people from their homes after Storm Desmond caused flooding in Carlisle. Storm Desmond has brought severe disruption to areas of northern England as dozens of flood warnings remain in place

-

20/30

5 December 2015Chickens wander around within the ‘Grow Heathrow’ protest camp, in Sipson, near Heathrow airport . The residents of the camp aim to stop or disrupt the proposed development of an extra runway at the airport due to the impact it would have on the environment and the lives of local residents. Members of the community fear that the village of Harmondsworth would be the location of the runway, meaning that many family homes would be either demolished or made unuseable

-

21/30

4 December 2015A new statue of the Beatles is unveiled by John Lennon’s sister Julia Baird (not pictured) outside the Liverbuilding, in Liverpool

-

22/30

3 December 2015A Tornado jet ahead of taking off from RAF Lossiemouth in Scotland, as RAF Tornado jets carried out the first British bombing runs over Syria, the Ministry of Defence has confirmed. The air strikes were carried out within hours of a vote by MPs in the Commons to back extending operations against Isis from neighbouring Iraq

-

23/30

2 December 2015Eric Marshall (75) turns on his Christmas lights at his home in Bagby, North Yorkshire which took four weeks to install

-

24/30

1 December 2015The giant sugar statues created by SodaStream went on display in front of the Houses of Parliament to mark National Sugar Awareness Week. The statues were made using the total amount of sugar from fizzy drinks consumed every minute by children, teenagers and adults in the UK

-

25/30

30 November 2015Marvel UK has unveiled an Ant Sized Street View platform that gives Brits an insects view point of the capital, to mark today’s Ant-Man DVD release. The interactive #AntSizedStreetView platform, allows fans to explore some of the city’s best known sights

-

26/30

29 November 2015Climate change demonstrators march to demand curbs to carbon pollution in London, on the eve of the climate summit in Paris

-

27/30

29 November 2015Malala Yousafzai stands next to a three-meter high portrait by artist, Nasser Azam at Birmingham’s Barber Institute of Fine Arts, in Birmingham

-

28/30

28 November 2015Protesters sit down in the middle of the road during a day of protest outside Downing Street against the possible British involvement in the bombing of Syria, in London. UK anti-war organisation, Stop the War Coalition, organised the protest in response to the proposed vote in Parliament by David Cameron to involve British forces in the bombing of ISIS targets in Syria

-

29/30

27 November 2015Salisbury Cathedral celebrates the beginning of Advent with a candle lit service and procession, “From Darkness to Light”, in Salisbury

-

30/30

26 November 2015Alex Salmond MP unveils a painting of himself at The National Gallery of Scotland in Edinburgh. The portrait by Gerard Burns depicting Mr Salmond in the main reception room of the First Ministers official residence Bute House, was acquired by supporters of Alex Salmond who was the leader of the Scottish National Party from 1990 to 2000 and from 2004 to 2014, and served as the First Minister of Scotland from 2007 to 2014

The former Business Secretary Sir Vince Cable, who warned in The Independent last month of the dangers of excessive household debt, said: “We’re back on the treadmill of growth being sustained by personal borrowing. Much of it is against an inflating housing stock.

“Taken together with other indicators like the very weak external deficit position, it suggests we’re getting back to the old and unhappily discredited forms of economic growth.”

The soaring amount of annual borrowing – equivalent to around £1,500 per family – emerged in the fine print of OBR calculations released alongside Mr Osborne’s Autumn Statement last month. The Chancellor used the occasion to announce he was able to scrap plans to cut tax credits and spending on police forces because of Britain’s improving financial position, but Labour said the new figures proved he was depending on families going deeper into debt to enable his figures to add up.

The OBR statistics showed households spent £68.9bn less than they earned in 2009-10. The figure fell to £67bn in 2010-11, £35.7bn in 2011-12 and £27bn in 2012-13. The following year Britain’s families went into the red to the tune of £12.4bn, rising to £29.4bn in 2014-15.

The OBR projects that households will spend £40bn more than they earn this year (2015-16), increasing to £40.4bn in 2016-17, £43.9bn in 2017-18, £48.6bn in 2018-19 and £49.5bn in 2019-20. Total household borrowing is set to reach £222bn over the lifetime of this parliament.

Ms Malhotra added: “Of course families need access to credit and the ability to borrow to invest for the future. George Osborne should be seeking to rebalance the economy away from an over-reliance on borrowing and debt.

“Labour is clear about the need for a strong and sustainable economic recovery. Osborne’s short-term political decisions risk real long-term damage to the finances of millions of British families and the nation’s economy.”

Meanwhile, the OBR predicts that Britain’s household debt-to-income ratio will reach 163 per cent in 2020-21, which is close to the 168.2 per cent level ahead of last decade’s economic emergency.

Citizens Advice said it dealt with 149,000 cases in England and Wales last year of people with problems over credit or charge card bills; 133,000 instances of people unable to repay personal loans and 60,000 cases of people asking for help with large overdrafts.

Gillian Guy, chief executive of Citizens Advice, said: “A rise in household borrowing could lead to an increase in unmanageable debt further down the line.” She added: “Increasingly younger people are finding it difficult to keep on top of their finances with over a fifth more young people now seeking debt help compared to the previous year.”

The figures follow a Bank of England study which found that the average mortgage debt in Britain rose from £83,000 in 2014 to £85,000 this year. Unsecured debt, which includes credit card charges, personal loans, student loans and utility bills, stands at round £8,000 per household.

The bank’s chief economist, Andy Haldane, has warned that consumer credit had been “picking up at a rate of knots”. It has hinted that it could raise interest rates to reduce the risk of a credit bubble.

A Treasury spokeswoman said: “The economy is recovering and confidence is returning, but while household debt is still below its pre-crisis peak we’re determined to avoid repeating the mistakes of the past. That’s why we’ve created the independent Financial Policy Committee within the Bank of England which ensures risks across the financial system are quickly identified, monitored and effectively addressed.”

- More about:

- Britain

- UK

- economic crash

- Debt